Freight rates could rebound this year: experts

Carrier executives are beginning to show optimism for a demand recovery.

Trucking companies might not have to wait until next year for relief from an extended freight rate downturn.

Carriers are beginning to signal improving market trends, and that may mean higher costs in the future for supply chain managers to move freight. Already, inventories are showing signs of normalizing and executives at some major trucking firms have said a return to normal could be around the corner.

“While customers still find themselves in a heightened state of uncertainty heading into 2024, virtually no one believes the current demand and capacity cycle is a new normal, or even that it’s durable,” Mark Rourke, president and CEO at Schneider National, said during the company’s Q4 earnings call. “The consistent question is, when does it change?”

Brokerages say there’s too much trucking capacity

Freight brokers agree the trucking segment remains oversaturated and more carriers must exit the market for balance to return.

Trends suggest more trucking companies are exiting and fewer are entering the market, said Jason Mansur, vice president of Enterprise Partnerships at Valley Companies, a Hudson, Wisconsin-based broker. However, the freight market beginning to stabilize may slow capacity departures, which may translate to little or no change in freight rates.

“Our take is that rates hit the bottom this past fall,” he said. “We have seen some markets begin to increase, but rates are still near the bottom. We don’t anticipate any further downward direction going forward.”

The prospects of rate stability as well as profits made during the pandemic may be another factor allowing some trucking companies to hang on despite the down freight cycle, said Ronnie Davis, vice president of vice president of North American Surface Transportation at C.H. Robinson.

“In a typical market cycle, 10-15% more capacity is added in the upcycle and a proportional amount leaves in the down cycle, this just hasn’t happened this time around,” Davis said.

Still, DAT Freight & Analytics Chief of Analytics Ken Adamo said trends suggest the freight market is poised for a recovery and that it has already passed the bottom of the cycle.

His analysis shows operating costs for smaller carriers are running at a breakeven point. In addition, e-commerce and brick and mortar sales were better than expected during Q4, which meant retailers flushed inventory.

“Inventory should be fairly depleted by this point,” Adamo said.

Even if this is the case, neither shippers nor carriers should expect a dramatic spike in rates. It would take a dramatic event — like another COVID-19 pandemic or ELD mandate — to impact the market, he said.

“There’s a lot of, I’ll say, tail breezes out there,” Adamo said, adding trends suggest “it will be a more tepid recovery.”

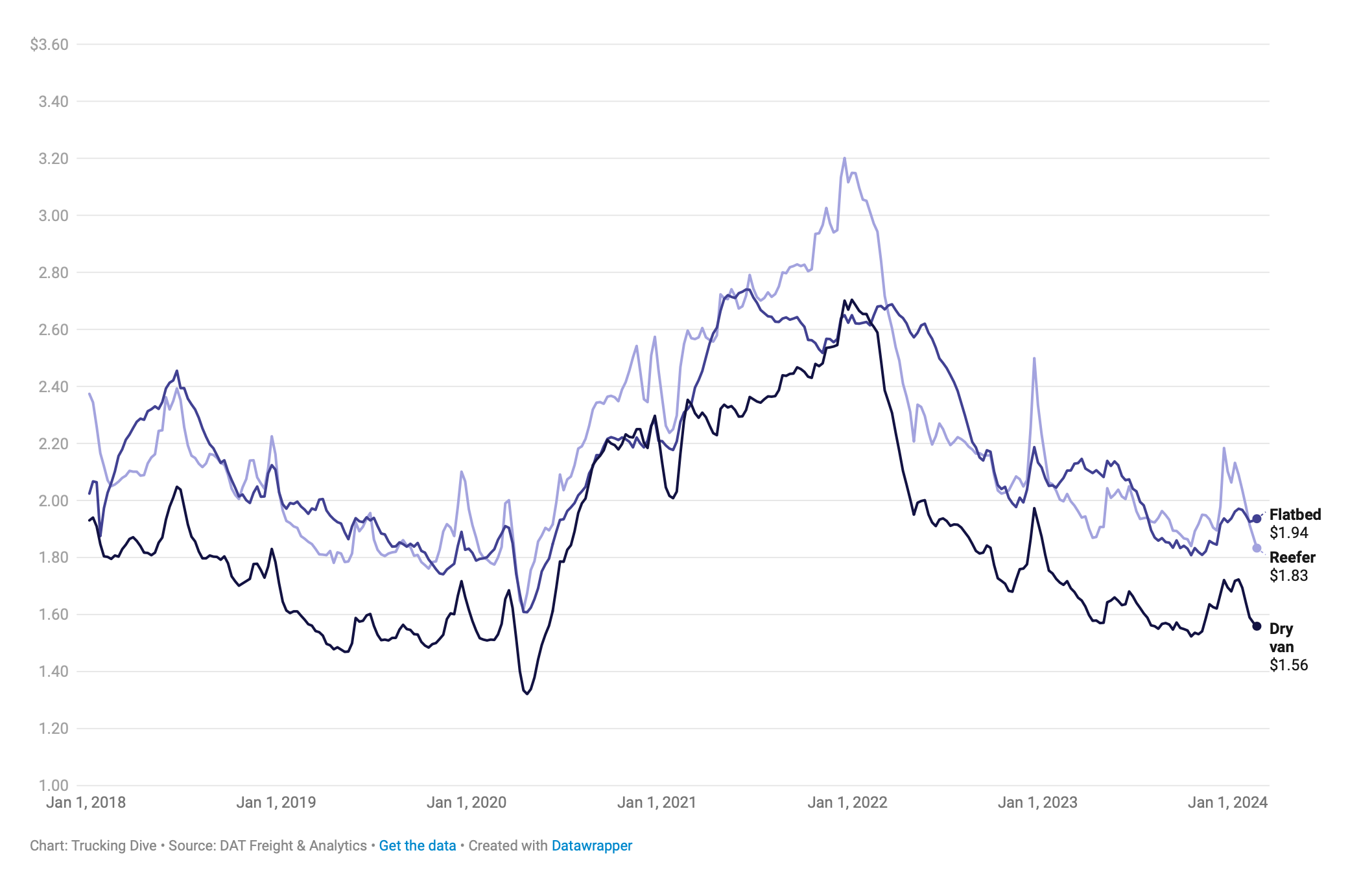

Trucking spot rates hit a trough last year.

Flatbed, reefer and dry van spot rates since 2018

Rates won’t stay this low forever

DAT data shows spot rates at the end of 2023 were down 10-12% year-over-year, while contract rates were down between 12-14% yoy, Adamo said. As a result shippers are trying to ensure the lowest prices now in anticipation of Q3 and Q4 needs.

Improving spot rates could become problematic for shippers — even for those with signed contracts. When spot rates spiked during the pandemic and continued into 2022, the market saw carriers abandon contracts to pursue the high spot rates, said Jonathan Phares, assistant professor, department of supply chain management, Iowa State University.

While few experts are predicting a spike in rates, several are suggesting shippers consider changes to their logistics management strategy as they prepare for a shift to a more carrier-friendly rate market.

Mansur, with Valley Companies, said shippers should be planning now for the market to turn. That may include budgeting appropriately or negotiating with carriers to strengthen relations to ensure capacity needs will be met.

In addition, Mansur said shippers should consider offering carriers more dedicated volume and adding flexibility to their loading or unloading practices.

“There are many methods to still help carriers so that when things turn, they remember the partnership you’ve created versus simply being just a rate shop,” he said.

Author

adminRelated posts

Trucks, trailers, tonnage: What transport data says about the state of the industry

Economic forces, consumer demand, seasonality, natural disasters [...]

UPS launches new Saturday home delivery service in Canada

The offering is currently available in Toronto’s greater [...]

Port of Baltimore crisis: What supply chain managers need to know

Supply Chain Dive asked experts how rerouting by [...]